does maine tax your retirement

3 on up to 20000 of taxable income for married joint filers and up to 10000 for those filing individually 699 on the amount over 1 million for. For more information call the Compliance Division of Maine Revenue Services at 207 624-9595 or e-mail compliancetaxmainegov.

The Most Tax Friendly States For Retirees Vision Retirement

A lack of tax.

. Less than 44950 for joint filers High. June 6 2019 239 am. The state does not tax social security income and it also provides a 10000 deduction for retirement income.

Also your retirement distributions will be subject to state. A traditional IRA offers investors retirement savings growth with tax benefits and easy withdrawals during retirement. If you believe that your refund may be.

In June 2021 Maine state legislature signed An Act To Promote Individual Retirement Savings through a Public-Private Partnership LD 1622 into law. Provincial Government Caregiver Tax Credit. State Income Tax Range.

A traditional IRA is not a one-size-fits-all retirement. Deduct up to 10000 of pension. Maine Income Tax Range.

Retiree paid Federal taxes on contributions made before January 1 1989. While it does not tax social security income. While Maine does not tax Social Security income other forms of retirement income are taxed at rates as high as 715.

On June 24 2021 Maine became the most recent state to enact a state-sponsored. Small Maine Employers Must Offer Retirement Plans. If you file as part of a couple and earn a combined income of between 32000 and 44000 up to 50 percent of your benefits may be subject to taxation.

By Joseph Begin July 27 2022. The 10000 must be reduced by all taxable and nontaxable social. One of the biggest factors that will determine your tax bill in retirement is where you live and.

Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. Your average tax rate is 1198 and your marginal tax rate is 22. Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states.

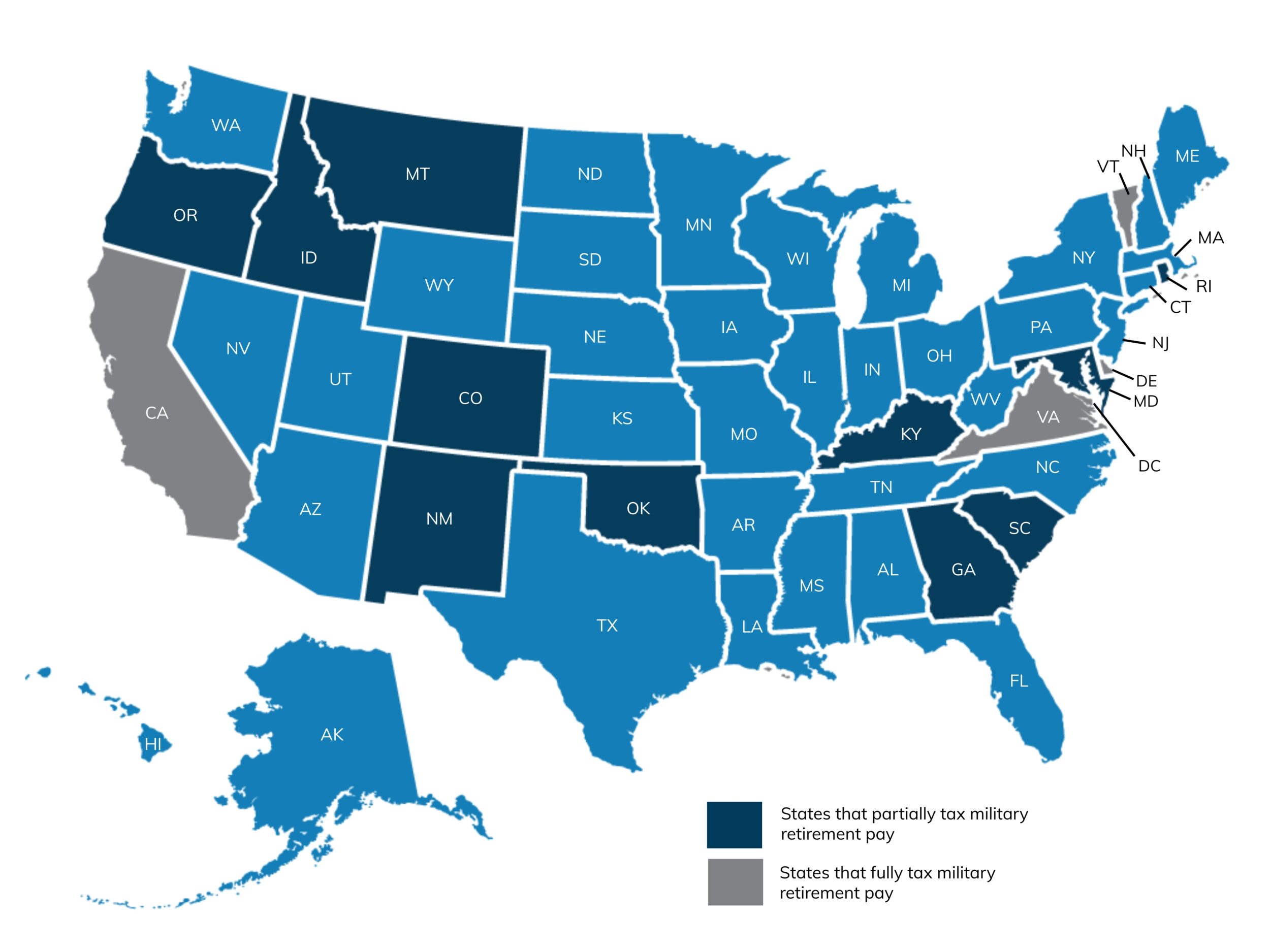

Does Maine Tax Retirement Pensions. Does Maine Tax Retirement Pensions. Maine does not tax active Military pensions - AT ALL.

One of the downsides to living in Maine is the fact that the income tax and retirement income tax rate can. The 10000 must be. One of the downsides to living in Maine is the fact that the.

On the other hand if you. June 6 2019 239 am. 715 on taxable income of 53150 or.

Formerly called crédit dimpôt remboursable pour proche aidant the tax credit for caregivers is also refundable and aims to. Maine Income Tax Calculator 2021. Also your retirement distributions will be subject to state income tax.

58 on taxable income less than 22450 for single filers. If you make 70000 a year living in the region of Maine USA you will be taxed 12188. Maine Public Employees Retirement System MPERS distributions need your special attention.

The Maine Public Employee Retirement System MPERS serves the public with sound retirement services to Maine governments. In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who received either a benefit payment or a.

Tax 103 104 Outgrown Your S Corp Retirement Plans For Your Business Tickets Mon Nov 14 2022 At 10 00 Am Eventbrite

How To File Taxes For Free In 2022 Money

Tax Withholding For Pensions And Social Security Sensible Money

Pension Tax By State Retired Public Employees Association

Pension Exemptions Benefit Wealthy Households And Compromise Resources Mecep

States That Don T Tax Retirement Income Personal Capital

Retiring These States Won T Tax Your Distributions

Maine Retirement Tax Friendliness Smartasset

15 States That Don T Tax Retirement Income Pensions Social Security

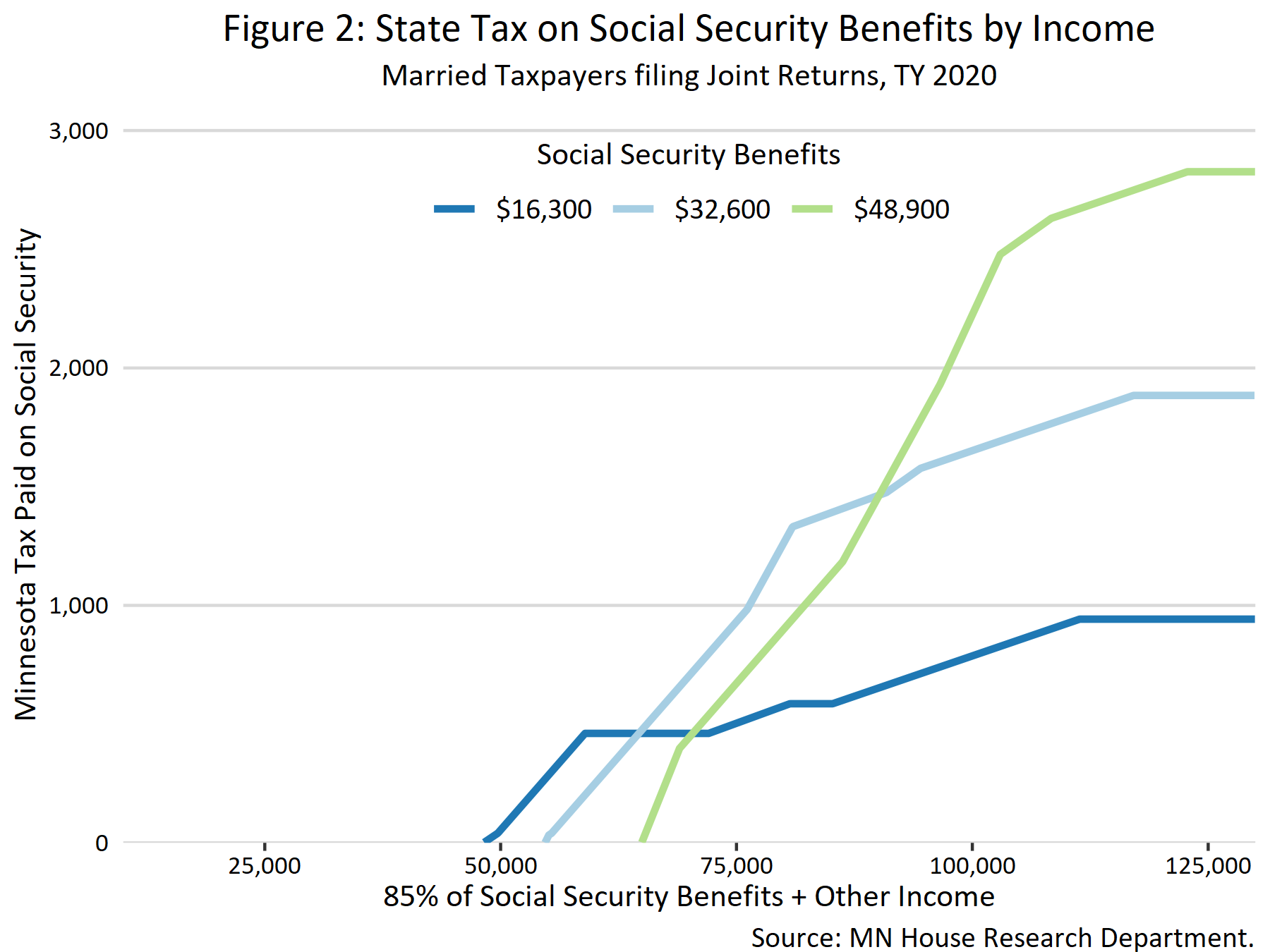

Taxation Of Social Security Benefits Mn House Research

11 Pros And Cons Of Retiring In Maine 2020 Aging Greatly

Maine State Taxes 2022 Income And Sales Tax Rates Bankrate

Maine Tax Rates Rankings Maine State Taxes Tax Foundation

State Taxation Of Retirement Pension And Social Security Income Wolters Kluwer

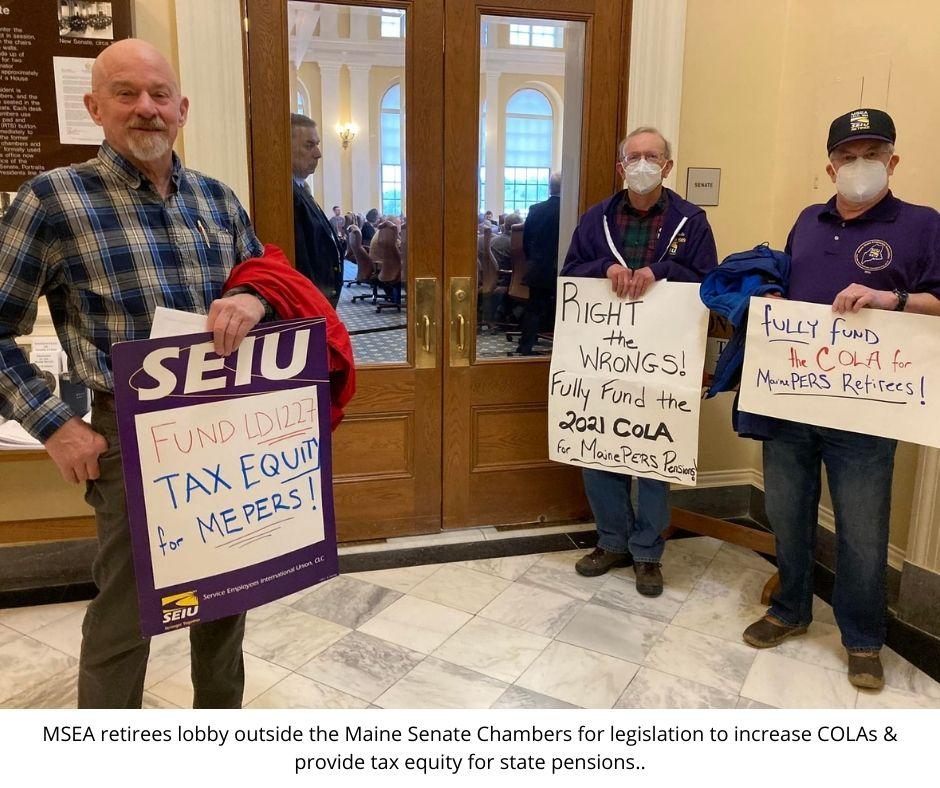

State Budget Contains Big Pension Improvements For Retirees Maine Afl Cio