individual food service revenue

As you may know this was the longest lapse in funding in US. If a direct deposit of your Indiana individual income tax refund was requested once DOR initiates the deposit our system will reflect the date the request was processed.

Food Trucks One Way To Eat Out During Pandemic

And 3 computation of unearned premium reserves under section 832b4 based on 100 percent.

. The food delivery market has seen significant growth over the past five years. Sales leases and rentals are taxable regardless of quantity or if the item is new or used unless an exemption applies. The Office of Tax and Revenue launched a new tax portal MyTaxDCgov.

The ADA is important to food service employers and employees. This tax portal will make it convenient to access account information schedule payments view transaction history file returns electronically and more. 2021 Personal Tax Returns are now available for completion in your new Revenue Service AccountYou will need to create an Individual MyGov.

Service charges arent reported as tips on Form 8027. USDA Foreign Agricultural Service Leading food and beverage processing companies based on gross revenue in the Philippines in 2020 in million US. By raising customer awareness through our marketing programs we strive to build revenue enhance satisfaction and achieve measured success.

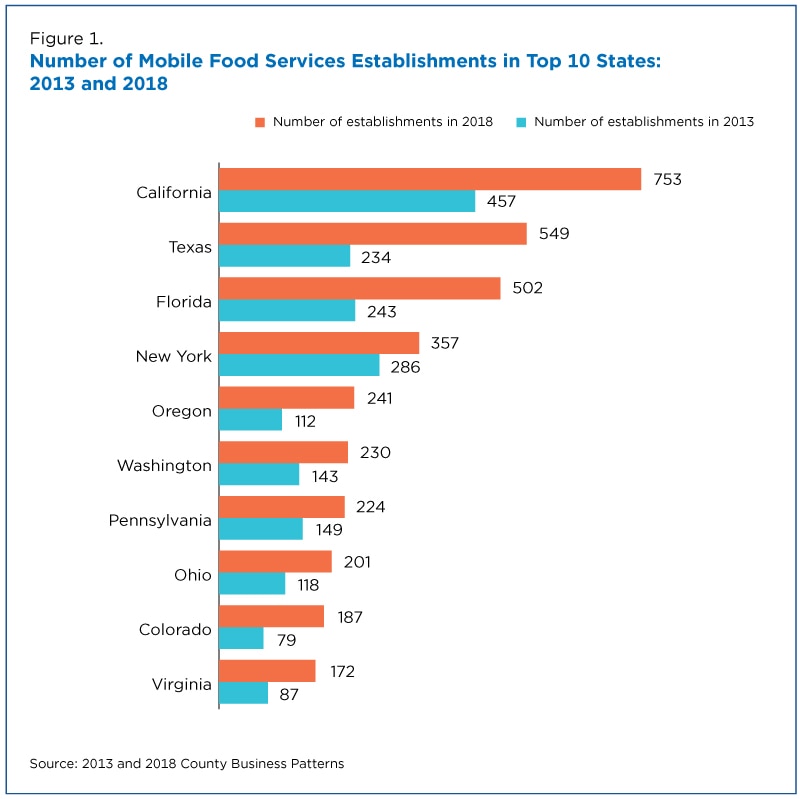

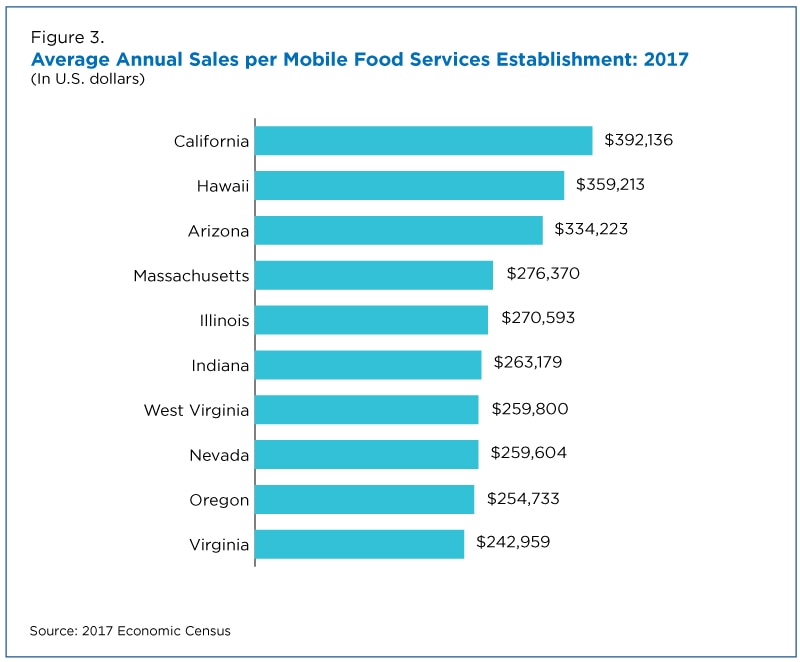

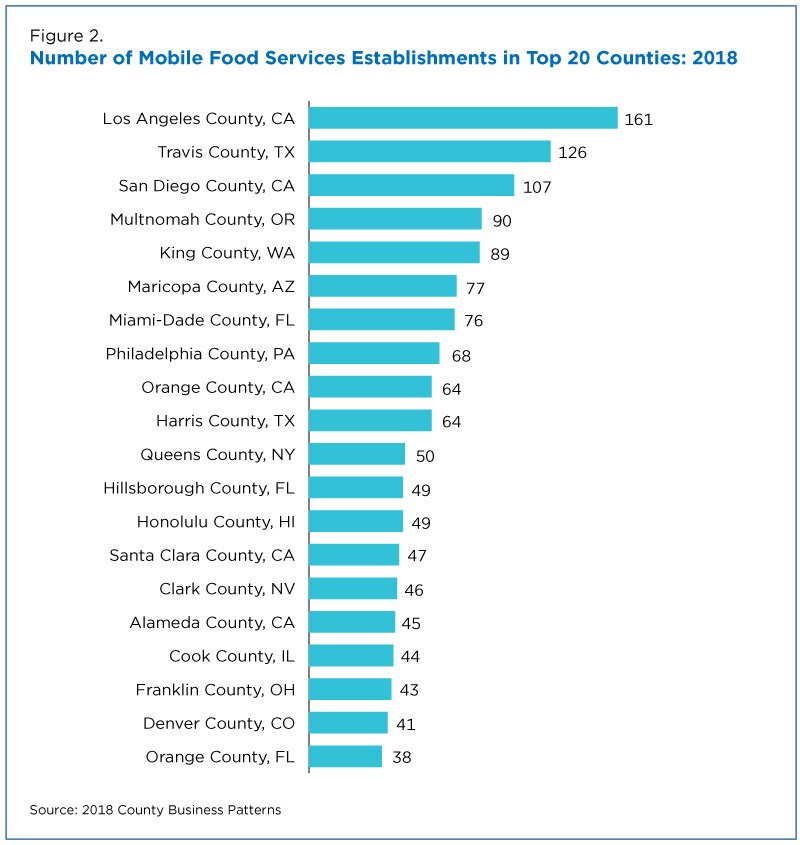

Street and Mobile Food Service Vendors. Revenue of specialized stores in organic food in the Netherlands 2013-2020. The Revenue Service is responsible for the collection of income tax and social security contributions throughout the Bailiwick of Guernsey.

Here taxpayers can get assistance quickly and efficiently in a comfortable professional atmosphere. Service charges are treated differently from tips for federal tax purposes. Section 833 of the Internal Revenue Code Code provides that Blue Cross and Blue Shield organizations and certain other qualifying health care organizations are entitled to.

Thanks to efforts over the last nine years that have allowed Indiana to fund critical needs while maintaining our states competitive tax environment many Hoosier taxpayers will receive a one-time 125 taxpayer refund under Indianas Use of Excess Reserves lawMore information including eligibility is available on DORs Automatic. The network effects of more delivery riders alongside route optimisations technologies has. Organic products per capita consumption 2017 by country.

Report child abuse or neglect. Food service workers with disabilities have rights under the ADA when applying for jobs or when working for a restaurant cafeteria or other food service employer. Revenue of organic supermarket chains in.

A retail sale also includes services for any purpose other than for resale. Led by platform-to-consumer services such as DoorDash and Uber Eats food delivery has expanded from takeaways to anything and everything adding billions of dollars in potential revenue capture. Assessments and Appeals FAQs.

The mission of the Department of Revenue is the timely courteous and prompt collection of all revenue due to the City of Philadelphia and all tax. Customer Service Center 1101 4th Street SW Suite W270 Washington DC 20024. Services for people experiencing homelessness.

The Office of Tax and Revenue OTR provides a state-of-the-art walk-in customer service facility which is available to meet District taxpayers needs. Food service employers must avoid discriminating against people with disabilities while obeying strict public health rules. 125 Automatic Taxpayer Refund Information.

Lessings Food Service Management portfolio encompasses over eighty accounts in the Northeast serving more than 40000 guests a day. 1 treatment as stock insurance companies. 2 a special deduction under section 833b.

A retail sale means any sale lease or rental of tangible personal property goods for any purpose other than resale sublease or subrent. Any portion of a service charge that is distributed to an employee is wages and you must withhold federal income tax social security tax and Medicare tax and include the amount on Form W-2 as wages. Individual Income Tax.

Birth marriage life events. Birth adoption and parenting. Most retail sales are taxable in Minnesota.

Normally it takes seven business days for your financial institution to receive and process the funds. If you have just arrived in Guernsey you will need to register with us as soon as possible. Find free food and meals.

How Four Food Businesses Started Selling Online During Covid 19

Operating Budgets And Income Statements Basic Kitchen And Food Service Management

Your Federal Income Tax For Individuals Irs Publication 17 2021 U S Government Bookstore

Food Trucks One Way To Eat Out During Pandemic

For Millions Of Low Income Seniors Coronavirus Is A Food Security Issue

Mcdonald S Revenue 2019 Statista

The Revenue Of Fast Food Chains In America Titlemax

How To Create A Restaurant Profit Loss Statement

Global Online Food Delivery Market Size 2027 Statista

Food Trucks One Way To Eat Out During Pandemic

What Is Food And Beverage Services Food And Beverage Industry Food Beverages

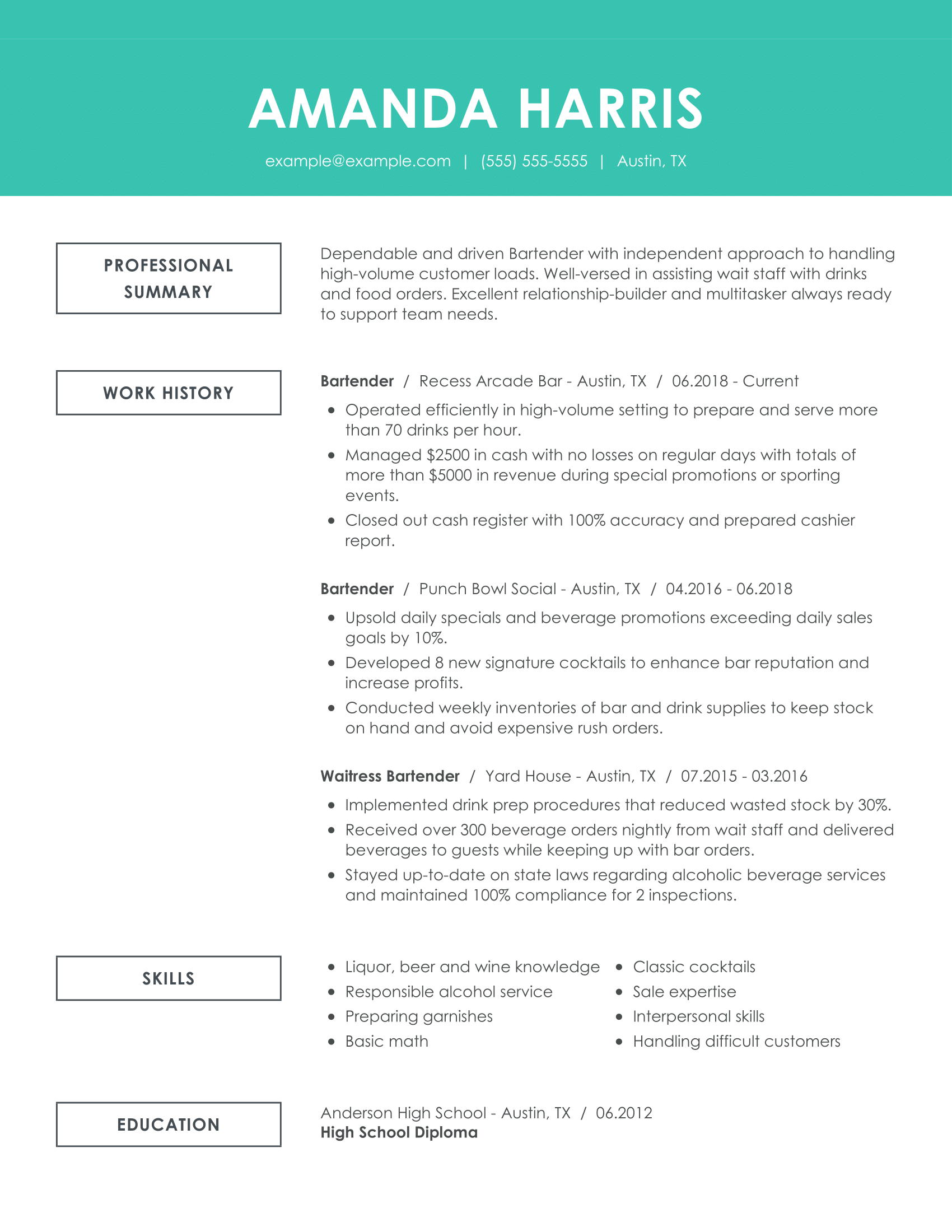

Professional Food Service Resume Examples Livecareer

Food Trucks One Way To Eat Out During Pandemic

Beyond Meat Inc Net Revenue By Sales Channel Worldwide 2021 Statista

Typical Restaurant Vs Qsr Quick Service Restaurant Quick Service Restaurant Commercial Kitchen Equipment Commercial Cooking